Your cart is currently empty!

Tag: juro

juro Digital Money: The Next Generation of Complementary Currency

All series of Juro Digital Money (“juro”) are defined as “money”. As such, all series of juro Digital Money meet the three standard functions of money: 1) Medium of exchange: Used as an intermediary in trade to avoid the inconveniences of a barter system, For example, the need for a “coincidence of wants” between the…

Diving into the U.S. Statutes that make juro possible

Juro-friendly Federal laws, State laws, and Definitions used by the government. Federal Statutes All of the series of juro Digital Money fall within the treatment and definition of “money”, “cash”, “funds”, and “money’s worth” in Title 31 of the US Code as well as in Title 11 of the US Code. Furthermore, the series of…

E.U. Statutes Applicable to juro

Laws and Definitions Used All of the series of juro Digital Money are treated and defined as “money”, “capital”, or “own funds” in the following pieces of E.U. legislation: Through this directive, the European Parliament passed legislation which clearly define what virtual currency is not, and also went further to differentiate complementary currencies, like juro…

U.K. Statutes Applicable to juro

Laws, Precedence, and Definitions. Statutes, laws, precedence, and definitions used by the Government of the United Kingdom All of the series of juro Digital Money are treated and defined as “money”, “capital”, or “own funds” in the EU legislation which was domesticated in the United Kingdom prior to “Brexit” and additionally by Section 583 (3)…

Issuance and Creation of juro Digital Money

Transparent and standardized mechanism for the issuance of the Juro’s complementary currencies. Juro provides a standardized, transparent, and functional protocol for the issuance of money as units referred to as “juro” where a holder of any of the eligible Standard Money Instruments, commodities, or in-ground assets (“Natural Capital“) can convert them into juro Digital Money.…

Highlights of the Juro Structure

Membership Org – Commercial Enterprise – Intergovernmental Activities The Membership Organization Defined and outlined in the Trust Deed, the irrevocable trust is a member association and is the uniform standards provider for a transparent platform of opportunity to fund, support, and promote the Juro Mission and member charities through the implementation and adoption of the…

Juro Economic Remediation™: The Permanent Global Bad Bank

A perpetual and standardized solution for everyone Juro™ has been designed to be used by governments and all participants in the global economy (individuals and legal entities alike) as a permanent and Perpetual Global Bad Bank. Juro is a corporate and trust structure which isolates illiquid, non-performing, and high risk assets, which meet the definition…

Global Debt Collection & Non-performing Loans

A Massive Market for Juro According to the Institute of International Finance (“IFF”) in November of 2019, Global debt is on course to end 2019 at a record high of more than $255 trillion. With a global population of 7.7 billion, that equates to about $32,500 of debt per person. There has been a $7.5…

Capital Raise+™

Next generation tools to raise capital One of the most robust economic stimulus mechanisms of the Juro Implementations is referred to as Capital Raise+™. This implementation uses juro Digital Money as paid-in capital when subscribing to shares for companies domiciled in the USA, EU, UK, and select WTO Member States. The subscription payment in juro…

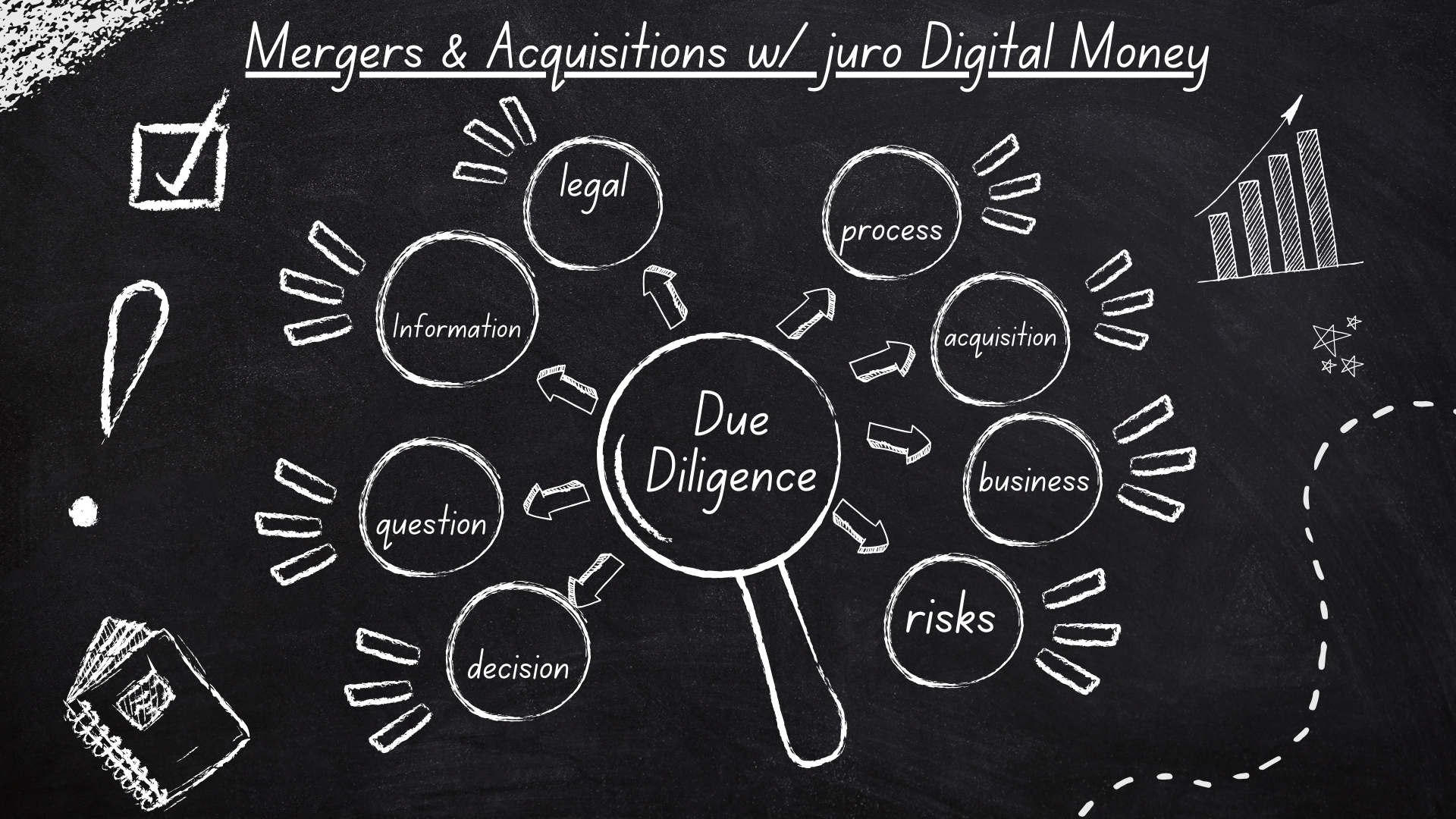

Mergers & Acquisitions w/ juro Digital Money

Juro Implementations for Real Estate and / or Operating Businesses When it is determined by a Seller and a Buyer that they want to transact a sale of a candidate real estate property or an existing income producing business (the “Property” of “Business”) for juro Digital Money, there are three versions of the process of…