Your cart is currently empty!

Investor Relations

Company: Juro Ltd (JURO)

Private company, planning a direct public offering

- Jurisdiction: The Bahamas

Common Stock: 10,000,000,000 shares

Par Value: $1.00 per share

Primary Standard Industrial Classification Code Number: 6712

Juro™ is a revolutionary financial platform that is designed to address some of the key challenges facing the global economy today. Our innovative approach to financial intermediation, coupled with our commitment to environmental remediation and sustainability, make us a unique and attractive investment opportunity for both short-term and long-term investors.

Join us and be part of the profitable shift in the global monetary order.

At the heart of our platform is the Juro Organization and the Members of the Juri, which act as a permanent and Perpetual Global Bad Bank. This structure isolates illiquid, non-performing, and high-risk assets and provides a standardized system for securitization through an in-kind subscription for units or applicable securities issued by a standardized asset-specific fund series of the Juro Revenue Sharing Program LLC.

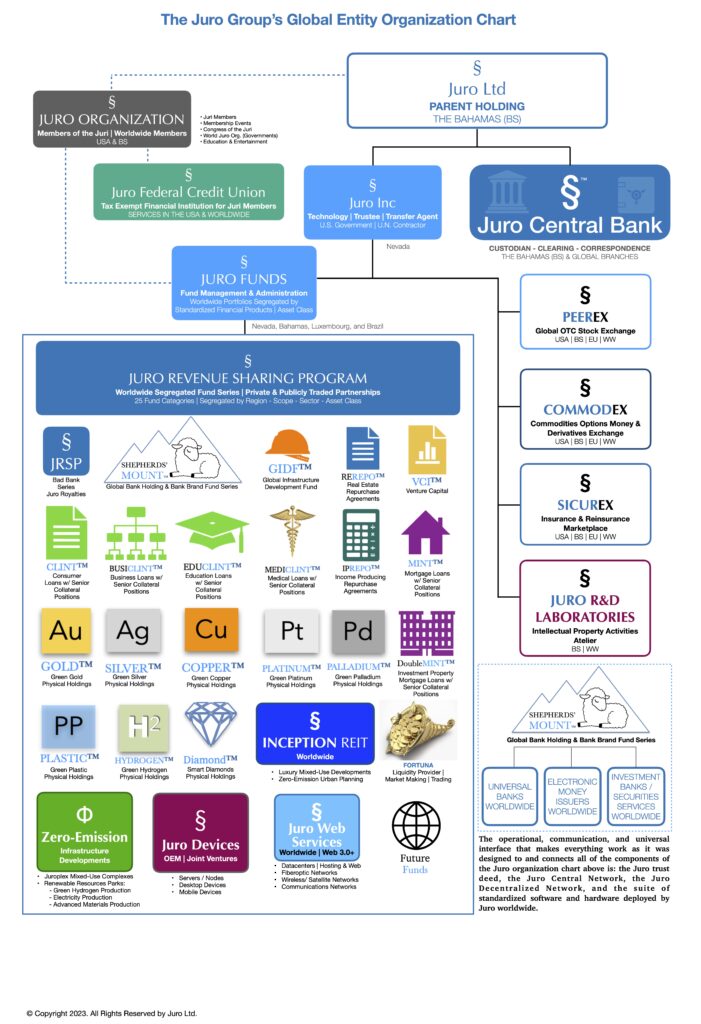

The Juro Group’s global entity structure is made up of the Members of the Juri and segregated legal entities.

This securitization process provides secondary markets and increased liquidity for participating economic players through our de novo neutral marketplaces, including the PEER-Ex stock exchange, COMMOD-EX commodities, futures, options, and derivatives exchange, SICUR-EX insurance marketplace, and CCJS economic remediation/capital conversion of the Juro System.

Additionally, Juro is committed to environmental remediation and sustainability through our Zero-Emission Developments and our investment funds, including all series of the Juro Revenue Sharing Program LLC and the Juro Money Zero Maturity ETF statutory trust (as applicable). These funds provide financial stability and support for environmental remediation efforts, which is an increasingly important concern for governments and businesses around the world.

Investing in Juro™ is not just about potential financial returns, it’s also about investing in a sustainable and responsible future. As the sole concession holder and authorized party to exploit the commercial enterprise of the entire Juro Project, Juro Ltd is committed to building a sustainable and successful company for the long term, leveraging its subsidiaries and affiliates.

In conclusion, investing in Juro™ is a smart and innovative way to participate in the global economy while also supporting environmental remediation and sustainability efforts. With a strong management team, a clear vision, and a commitment to responsible growth, Juro™ is well-positioned to revolutionize the financial industry and make a positive impact on the world.

The board of directors of Juro Ltd encourage you to invest in Juro™ today and become a part of our exciting journey towards a more sustainable and prosperous future for all.

Invest in securities issued by Juro™, Juro Funds™, and more!

We have only one class of common stock. There are 10,000,000,000 shares of common stock and each share is entitled to one vote. These shareholders represent 100.00% of the voting power of our outstanding capital stock. No shares of common stock are being offered by the company, as the shares were initially offered and completely sold at the Company’s incorporation with a stock swap with Juro System Inc. Juro System Inc was subsequently dissolved as a company. Any trading or sales of the common stock shall be in transactions which are exempt from registration pursuant to Rule 144 of the U.S. Securities Act of 1933, and Regulation S, where applicable.

Common Stock Shareholder Agreement Parameters

At no time may a founding shareholder sell a share in the company to a non-founder for less than the minimum price of $6.00 per share. Prior to the DPO, any “non-founder” shareholder may sell a share in the company to another shareholder for any price that is equal to or greater than the par value of the stock up until the listing of the shares on a regulated stock exchange. After the time of a listing, for a period of one calendar year, no shareholder that was registered as a shareholder prior to the DPO may sell a share in the company to anyone for a price that is less than the opening trading price, whatever that may be.

Possibility of the Acquisition of common stock or other securities: Any shares of common stock which are available for purchase as from a existing shareholders and not offered by the company. Prior to any public registration of securities, said securities may only be offered or sold in private transactions or in a private placement transaction which is exempt from registration in accordance to regulation D of the Securities Act of 1933, rule 506(c) , Regulation S, and rule 144(a), and may be further subject to the above Shareholder Agreement Parameters. Prospective investors should consult their own legal, investment, and tax advisors regarding any purchasing, holding, and disposing of our common stock or other securities, including the consequences of any proposed changes in applicable laws.

We have one series of Senior Perpetual Preferred Stock with a fixed annual dividend of 6.00% which shall accrue without interest, however this series is offered on an open-ended basis and is subject to the exemptions from registration in accordance to Regulation D, Rule 506(c), Regulation S, and Rule 144(a), as it is primarily offered to licensed financial service providers in accordance to such exemptions from registration. At the time of the publication of this website, there were 50,000,000 authorized to be issued in the first instance, however no shares had been offered or otherwise allocated by the company. These shares can be purchased at anytime in accordance to Rule 144 and Rule 144a, as applicable.

We do not have any other series of equity securities.

DEBT SECURITIES

The Company has authorized an open-ended zero-coupon senior debt series of securities with two year maturities, however at the time of the publication of this website, we had not issued, allocated, or otherwise taken any action to cause any debt securities of the Company to be outstanding. The company shall offer its debt securities as a shelf offering subject to the exemptions from registration in accordance to Regulation D, Rule 506(c), Regulation S, and Rule 144(a).

WARRANTS, OPTIONS, & OTHER RIGHTS

We do not have any warrants, options, or other rights associated to the issuance or allocation of any securities other than the provisions of the Sole Series of Common Stock as described in the company register and as described in the private placement memoranda.

Regulatory Matters

The Securities and Exchange Commission and state securities regulators of the United States, and the respective regulators of the Bahamas and any other country have not approved or disapproved our securities, or determined if our private placement memoranda are truthful or complete. Any representation to the contrary is a criminal offense.

Transfer Agent and Registrar

Juro and each respective affiliate and subsidiary serve as their own transfer agent in their capacities as issuers, utilizing the Juro System.

No public market for our sole series of Common Stock, or any of our other securities, currently exists.

Investments shall only be accepted from either:

- An “Accredited Investor” within the meaning of Rule 501 of Regulation D promulgated under the Securities Act of 1933; or

- A “Qualified Institutional Buyer” or “QIB” within the meaning of Rule 144A of the U.S. Securities Act of 1933; or

- A “Sophisticated, Knowledgeable Investor” (either alone or with the aid of a purchaser representative) with adequate net worth and income for this investment as defined in Directive 2003/71/EC of the European Parliament and of the Council of 4 November 2003, as amended.

Prior to any public registration of securities, said securities may only be offered or sold in private transactions or in a private placement transaction which is exempt from registration in accordance to regulation D of the Securities Act of 1933, Rule 506(c), Rule 144(a), Regulation S, Rule 144, and may be further subject to the existing Juro Shareholder Agreement Parameters.

Prospective investors should consult their own legal, investment, and tax advisors before investing.

{regarding any purchasing, holding, and disposing of our common stock or other securities, including the consequences of any proposed changes in applicable laws}

Direct investments in Juro™ offerings are made through a fully active investment account system for individuals and legal entities.

Account types include IRA’s, trust accounts, and more!

The offerings are made through a cooperation between Juro Ltd and our Affiliates.

NOTE:

THIS WEBPAGE IS FOR INFORMATION PURPOSES ONLY AND DOES NOT CONSTITUTE, OR FORM PART OF, ANY OFFER OR INVITATION TO SELL OR ISSUE, OR ANY SOLICITATION OF ANY OFFER TO PURCHASE OR SUBSCRIBE FOR ANY SHARES OR ANY OTHER SECURITIES, NOR SHALL IT (OR ANY PART OF IT), OR THE FACT OF ITS DISTRIBUTION, FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION WITH, ANY CONTRACT THEREFORE, TO, FROM OR WITH ANY PERSON IN ANY JURISDICTION TO WHOM OR IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL AND THEREFORE PERSONS INTO WHOSE POSSESSION THIS DOCUMENT COMES SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH RESTRICTIONS.